Providing risk and capital relief to banks on core loan portfolios

A Relative Value Perspective

Analysis of the relative value of Risk Sharing vs High Yield bonds

SRT Chronicles 2024

A detailed overview of the SRT market

Extracting Investor Value

Why banks issue SRTs and how investors approach the market

Resilience of Risk Sharing

Modelling the resilience of SRT transactions

Accessing banks’ relationship lending portfolios through risk sharing

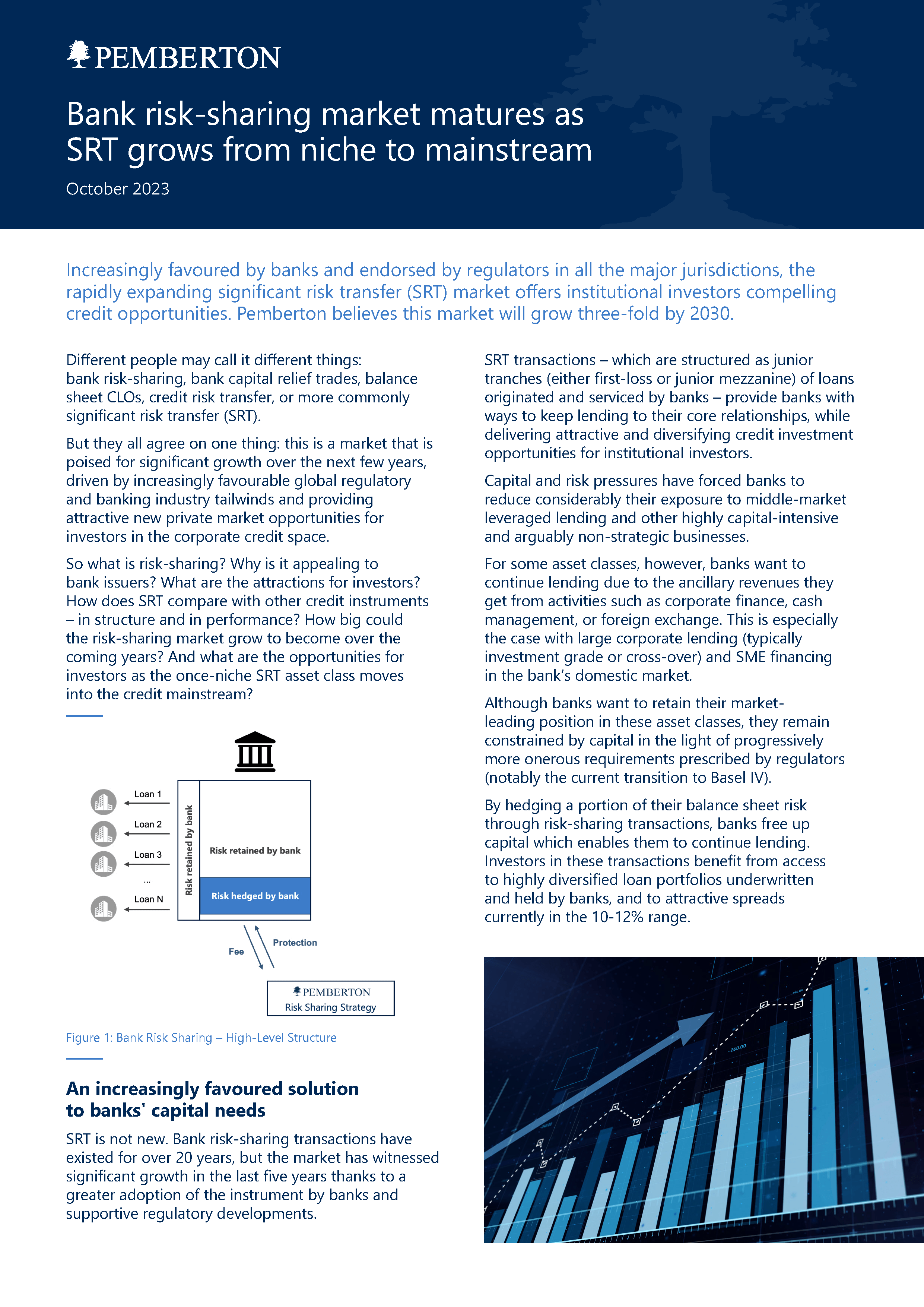

The strategy focuses on:

- Investments in junior tranches of loan portfolios originated by global banks and leading European lenders;

- Transactions that are designed for banks to continue lending to core relationships (not legacy assets);

- Underlying portfolios comprising mainly corporate, SMEs and trade finance exposures.

Since the implementation of Basel III banks have looked at ways to maintain or grow their loan portfolios under increasingly constraining capital requirements. Bank risk sharing transactions provide risk and capital relief to banks to continue lending to their clients. The market for risk sharing transactions has grown steadily by over 20%1 per annum since 2010 and we expect it to continue growing due to an increasingly favourable regulatory framework and greater adoption of the technology by banks globally.2

Pemberton’s Risk Sharing Strategy focuses on junior tranches of Risk Sharing transactions which provide efficient relief to banks while delivering attractive risk-adjusted returns to investors. The asset class benefits from comparatively high diversification (each asset references hundreds or thousands of loans) and from the mismatch between the amount of risk banks need to hedge to obtain capital relief and projected losses in their core loan portfolios.

We believe that Pemberton’s platform combining local origination in 9 European jurisdictions, extensive credit analysis capabilities and expertise in bank capital is well positioned to help investors access this interesting area of private credit.

The strategy is managed by Portfolio Manager Olivier Renault.

1Pemberton estimates based on data collected from bank annual reports, stock exchanges and dialogue with law firms, issuers and other market participants. Excludes public-sector transactions.

2For example the implementation in 2021 of the Simple, Transparent and Standardised framework for balance sheet securitisations by the European Union.

Meet the team

Olivier Renault

Managing Director

Anna Neri

Associate, Risk Sharing